Table of Contents

What is the Asset Turnover Ratio?

The asset turnover ratio is a ratio of the efficiency with which a company uses its resources to generate income or sales. The ratio compares a company’s total revenue to average total assets to reveal the sales generated for each dollar of company assets. The higher the asset ratio, the more significant the company’s assets will be used.

The asset turnover ratio is generally used by third parties, such as investors and creditors, to assess the efficiency of a company’s operations and understand how effectively each company uses its resources to generate income. By comparing firms in similar sectors, investors and creditors can discover which companies are making the most of their assets and what weaknesses others might have.

Why is the Analysis of the Asset Turnover Ratio Important?

A more excellent ratio is always more favorable because it reflects how efficiently a company utilizes its assets to create revenues. Higher turnover ratios indicate that the company is using its assets better. Lower ratios suggest the organization isn’t using its resources best and likely has management or production issues. Investors use the asset turnover ratio to compare companies in the same sector or group.

Huge asset sales and substantial purchases in a given year can influence a company’s asset turnover ratio. A comparison of the asset turnover ratios of a retail company and a telecoms firm would not be particularly productive because this ratio varies so much from one business to the next. Comparisons are only meaningful when made for different corporations within the same sector.

The Formula for the Asset Turnover Ratio

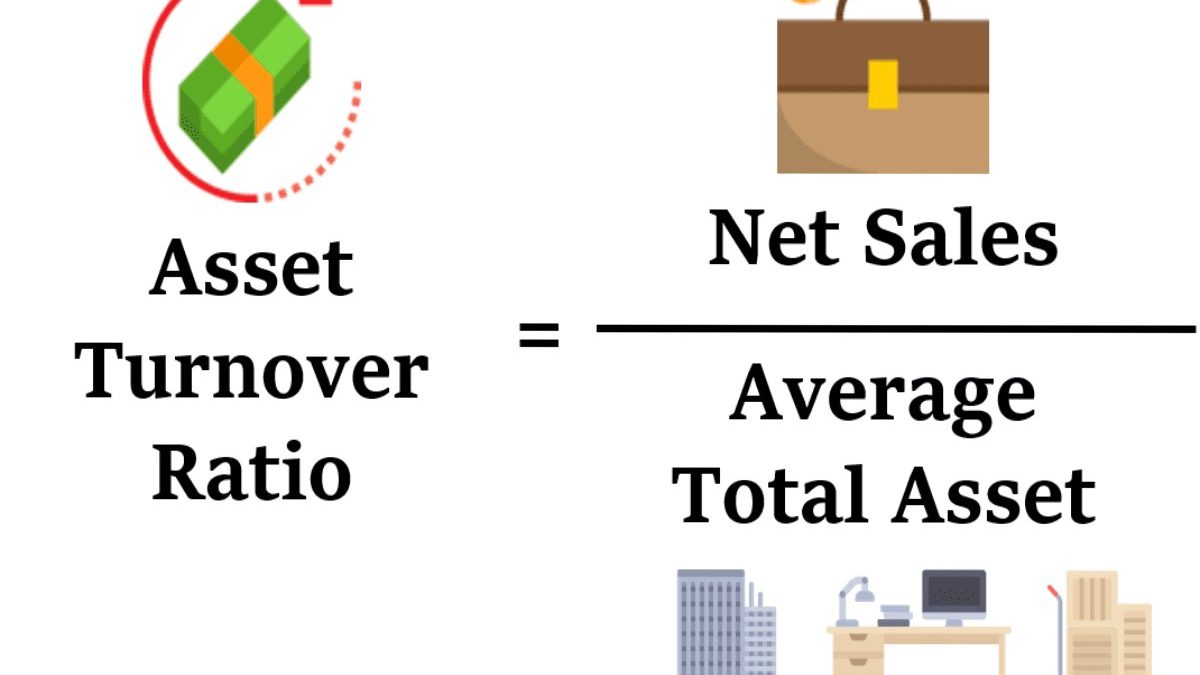

The asset turnover formula is as follows:

Asset Turnover Ratio Formula

Where:

- Net sales are the revenue made after deducting sales returns, discounts, and allowances.

- Average total assets are the average overall assets at the year-end of the current and preceding fiscal year. Note: an analyst may use either average or end-of-period assets.

How to calculate the asset turnover ratio?

Most corporations calculate the asset turnover ratio yearly, using balance sheets from the start and end of the fiscal year. The asset can be calculated by dividing total income by average assets. It should look like this.

Asset turnover ratio = gross income ÷ average total assets

The average total assets can be known by adding the starting and ending purchases and dividing that sum by two. It should look like this.

Average Total Assets = (Initial Assets + Final Assets) ÷ 2

In this equation, the primary assets are the total assets documented at the beginning of the fiscal year, and the ending assets are the real assets documented at the end of the financial year.

Calculation

Any company has a total gross income of Rs.20 lakhs at the end of the fiscal year. As per the balance sheet, the resources at the start of the year are Rs.5,00,000, and the total assets at the end of the fiscal year are Rs. Seven lakhs.

- Average Total Assets is = 5,00,000+7,00,000/2 = 6,00,000

- Asset Turnover Ratio is = 20,00,000/6,00,000

- Asset Turnover Ratio = 3.33%

Therefore, this ratio indicates how capably the corporation generates sales with every rupee financed in its assets.

Interpretation of Asset Turnover Ratio

The asset turnover ratio determines how effectively a firm uses its assets to generate sales or revenue. Now, this value can be influenced by several factors. For instance, a low ratio may indicate inadequate inventory management, excessive production capacity, and more. A low asset turnover ratio could be seen as a red flag.

Additionally, the asset turnover ratio may be higher for some industries than others. Take the example of retail. Despite lesser assets, this sector has a high turnover ratio! While conversely, the healthcare sector, with an impressive and large asset spread, does not enjoy a high turnover ratio. In this sense, comparisons are helpful between companies in the same industry.

Therefore, by benchmarking and comparing the asset turnover ratio to the industry average, you can establish whether it is functioning well.

Advantages of Asset Turnover Ratio

The asset turnover ratio is essential for investors and may influence their decisions. Read further to know about the advantages.

Measure Company Performance

The asset turnover ratio is used to analyze a company’s performance. And as investors constantly look for investment opportunities, a high asset turnover ratio could attract new investors.

Saves Extra Expenditure

Management should consider the advantages an asset offers before purchasing it. It can help cut down on wasteful spending.

Facilitate Comparison

It is a measure investors use to compare one company with another within the same sector before any decision-making.

Indication of Asset Impairment

The ratio can indicate asset impairment. For instance, a sudden drop in the ratio may indicate that the company assets are losing their ability to generate income.

Is it Better to Have a High or Low Asset Turnover?

Generally, a high asset turnover ratio is preferred. It is because a high percentage shows that the company successfully employs its assets to a good capacity. Conversely, a low turnover ratio may tell an investor that the organization needs to deploy its support to its maximum potential.

Importantly, you could be misreading this ratio if you compare companies from different sectors. Lastly, regardless of the asset turnover ratio, a company has to perform well on various metrics and valuations to qualify as an investment option.

Conclusion

The asset turnover ratio is a measure that contrasts revenues with assets. A company with a vast asset turnover ratio may attract higher investors. Like other indicators, the asset turnover ratio works best compared to companies in the same sector. Understand the asset turnover ratio to choose companies utilizing their assets efficiently.